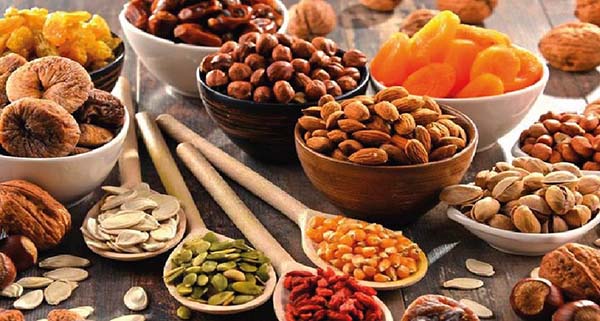

The price of dry fruits has risen due to an unusual increase in VAT, and this is having a big influence on culinary goods in bakeries, hotels, and restaurants as well. The government has raised the value-added tax (VAT) on roughly 100 products. An ordinance addressing this was issued on Thursday. As a result, dry fruit prices are rising in wholesale marketplaces. The price increase for imported dry fruits will have an impact on food products manufactured in bakeries, hotels, and restaurants. The VAT on restaurant food has already been increased from 5% to 15%. Industry sources are concerned that the price increase in dried fruits will have a substantial influence on prepared food prices.

The price of dry fruits has risen: The majority of the country’s dried fruits are imported. Dry fruits such as raisins, almonds, cashews, pistachios, peanuts, sweet potatoes, dates, and walnuts are used both as direct food items and in the manufacture of food products. Dry fruits are frequently utilized in wedding, religious, and social event cuisine. They are primarily utilized in foods such as biryani, kacchi, cakes, payesh, cookies, sweets, and firni. The price increase will raise the production costs of certain food products. Furthermore, with the VAT on restaurant food sales increasing from 5% to 15%, business owners anticipate that prices would rise even further.

In Khatunganj, the country’s largest wholesale market for consumer goods, it was discovered that after the formal edict for VAT increase was published on Thursday, prices of numerous products began to rise on Saturday afternoon. There was a big price difference between Saturday morning and afternoon. In a single day, the price of raisins rose by 40 taka per kg, almonds by 35-40 taka, cashews by 15-20 taka, pistachios by 100 taka, dates by 15-20 taka, sweet potatoes by 25-30 taka, and peanuts by 4-5 taka. With the likelihood of more price increases, merchants have stated that prices will remain under pressure as a result of increasing buying activity in the market.

In Khatunganj, the country’s largest wholesale market for consumer goods, it was discovered that after the official VAT increase ordinance was published on Thursday, the prices of numerous products began to climb on Saturday afternoon. A considerable price difference was found between Saturday morning and afternoon. In just one day, the price of raisins rose by 40 taka per kg, almonds by 35-40 taka, cashews by 15-20 taka, pistachios by 100 taka, dates by 15-20 taka, sweet potatoes by 25-30 taka, and peanuts by 4-5 taka. With the likelihood of more price increases, merchants have stated that prices will remain under pressure as a result of increased market buying activity.

When asked, Md. Kausar Alam, senior manager of Messrs. Najim & Brothers in Khatoonganj, stated, “After the government announced that the VAT rate would be increased, the demand for imported goods in the wholesale market increased.” Many people have started buying dried fruits, fearing that market prices may rise. However, some people have stockpiled them and are selling them at higher rates, resulting in a somewhat artificial scarcity. As a result, wholesale dry fruit prices have risen since Saturday. Because the majority of the country’s dry fruits are imported, even though the VAT rate rise is not directly applied, the news has produced market volatility.”

Before raising the VAT, several changes were made, and the draft Value Added Tax and Supplementary Duty (Amendment) Ordinance 2025 was adopted in principle at the Advisory Council meeting on January 1, subject to vetting by the Parliamentary Affairs Division. On January 9, the President issued an ordinance in this regard. This regulation imposes a 15% VAT on restaurant bills. Previously, air-conditioned restaurant bills included a 5% VAT. In addition, the VAT rate on apparel outlet bills has been hiked from 7.5% to 15%, as has the VAT rate on sweets.

Meanwhile, in order to curb inflation and alleviate people’s suffering, the Consumer Association of Bangladesh (CAB) has called for the repeal of the VAT and extra duty increases. In a statement made yesterday, CAB leaders stated that Ramadan will begin in the first week of March. During Ramadan, prices of commodities climb due to hoarding habits. Although vegetable prices have dropped during the winter, the price of rice has risen by 10-15 Taka per kilogram, depending on the type. With the current increase in VAT and extra charge, businesses are expected to boost their prices once more. The organization voiced fear that food prices, in particular, would rise beyond the means of the poor and lower middle class.

When asked, CAB Vice President SM Najir Hossain stated, “Even though food inflation has been gradually rising in the country, VAT has been increased on several food-related items.” Furthermore, the introduction of VAT on restaurants will significantly increase the cost of life for ordinary people. While prices for commodities like as dried fruits had been relatively consistent, the current price rises will result in greater costs for social, family, and religious activities, and ordinary people will confront significant challenges, he voiced concern.”

According to wholesale dealers, dried fruits such as dates, raisins, and almonds are in high demand throughout Ramadan. In addition to ordinary consumers across the country, hotels, restaurants, and food-producing companies acquire dry fruits for the creation of sweets. Prices of nuts and dry goods have been rising in the wholesale market for the past one and a half months as a result of the VAT rise issue. Traders are afraid that, following the recent increase in the value of the dollar, the rate of imports has slowed, and prices may climb much further.

The price of dry fruits has risen… The price of dry fruits has risen.. The price of dry fruits has risen.. The price of dry fruits has risen… The price of dry fruits has risen .. The price of dry fruits has risen.. The price of dry fruits has risen.. The price of dry fruits has risen..